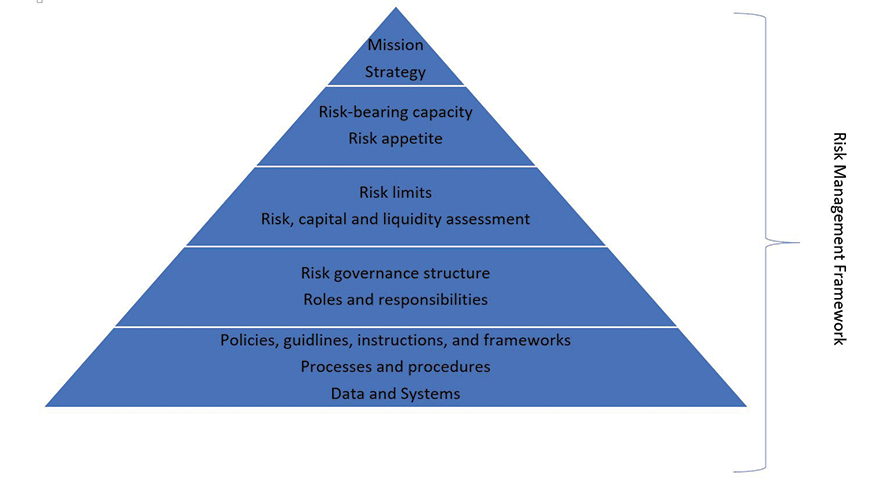

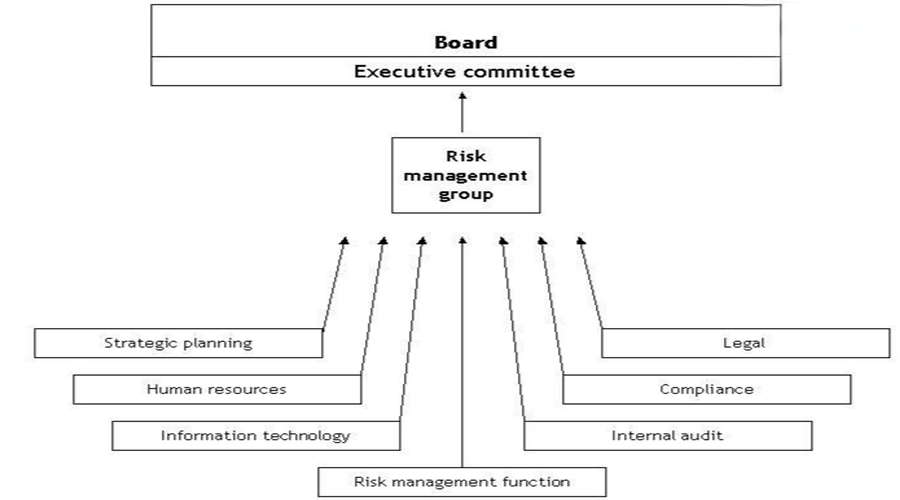

At SDI Holding, our risk management framework is designed to manage the Company’s risk-taking in the context of its mission and strategy, and taking into account its risk bearing capacity, willingness to take risks (risk appetite), and minimum quantitative requirements for capital, leverage and liquidity. The willingness to take risks is described in the SDI Risk Appetite Statement (“RAS”) with the purpose of aligning SDI’s risk-taking with the statutory requirements, strategic business objectives and capital planning. The RAS provides a clear articulation of the high level principles for SDI’s risk-taking, risk mitigation and risk avoidance. The RAS is reflected in this Risk Management Policy (“Policy”) which sets out the overall principles for the management of SDI’s key risks, covering credit risk, market risk, liquidity risk, operational risk, model risk, climate risk, and compliance risk. In addition to this Policy, the risk management framework consists of several more detailed risk category specific policies, guidelines, procedures and internal controls. The framework is supported by an effective risk measurement and limit system as well as risk data and systems. An adequate risk governance structure and competent staff are other key elements of the Company’s risk management framework.

At SDI we operate across the board in all financial bonds , securities and financial instruments and private placement programs for small cap and larger investors. We have strong ethical practices, protocols and working knowledge with approvals where required to manage large investment portfolios with a dynamic, balanced growth potential of investment returns.

With the tracking and monitoring culture we adhere to,

co-ordinated efforts across the board of the Company we are able to make meaningful financial projections. Communication within the departments of the Bank

as well as obtaining external data and information is central to our success formula.

At SDI we recognise that financial forecasts and projections are a critical tool for a successful business. For most businesses, bank financing is essential for growth. Obtaining a line of credit, term loan, equipment loan or real estate mortgage for your business will require substantial documentation to demonstrate the strength of your business, use of the funds and your ability to repay the loan.

Therefore, our services are tailored to your needs and include:

We have a strong edge for turn around consulting with dynamic multi skilled teams with common

goals and targets. This is much needed in global adverse market conditions to minimise wastage of

valuable assets in commerce, industry, agriculture, and human resources. Our Chairman’s mantra is ‘If it is not

broken we don’t fix it, but if it is broken our philosophy is that we repair it before we waste and replace it.

In the most urgent situations, businesses need to stabilise their finances and improve their operations to preserve value. Working alongside management, investment bankers, lawyers, and other professionals, we help companies improve results for the benefit of all stakeholders.

We work with short and long-term horizons, and our efforts are designed to have immediate, material, and quantifiable positive impacts.

Our services include:

At SDI we focus on value creation we have the capability of providing our clients with a range of services, combining technical excellence with real-world experience, industry knowledge and a wholly professional approach. Our areas of expertise within Audit and Insurance include: Internal and External Audit Due Diligence Corporate Reporting IT Systems Assurance Tax Advisory

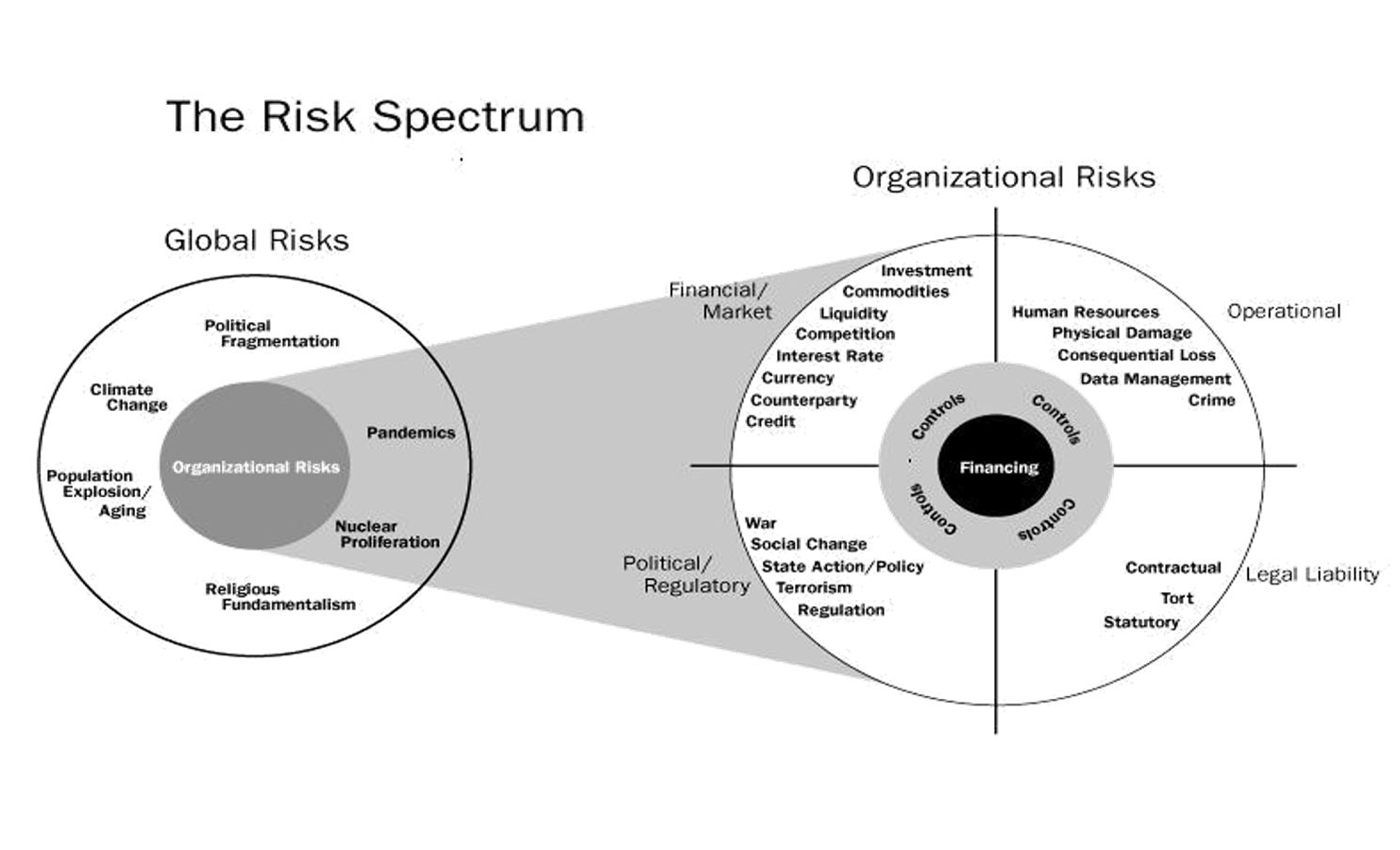

At SDI we are critically aware of global risks and continually implement checks and balances to navigate trying times as well as reap rich rewards from key opportunities for boom marketplaces. Our Chief Risk Officer is committed to communicating across the business with a holistic approach, with an acute understanding of the business risks and rewards operating with a proactive and dynamic approach. This leadership culture is echoed and translated across the business so that all departments are working in unison with common goals enhancing the strength of the Company and the people working across the organisation and other external stake holders.

To maintain confidence we maintain adequate capitalisation of the Company, These general reserves remain in place to protect our clients investments from known and unknown risks averting losses and optimising their returns. This is managed 24/7 on a global basis.

As part of infrastructure development, there are slow burners where humanitarian aid and strategic infrastructure programmes are essential for the longer term turn around. Ironically, many of these regions, such as Africa, have the richest reserves and offerings, providing those with the foresight to invest heavily into the people and the countries to manifest their full potential.

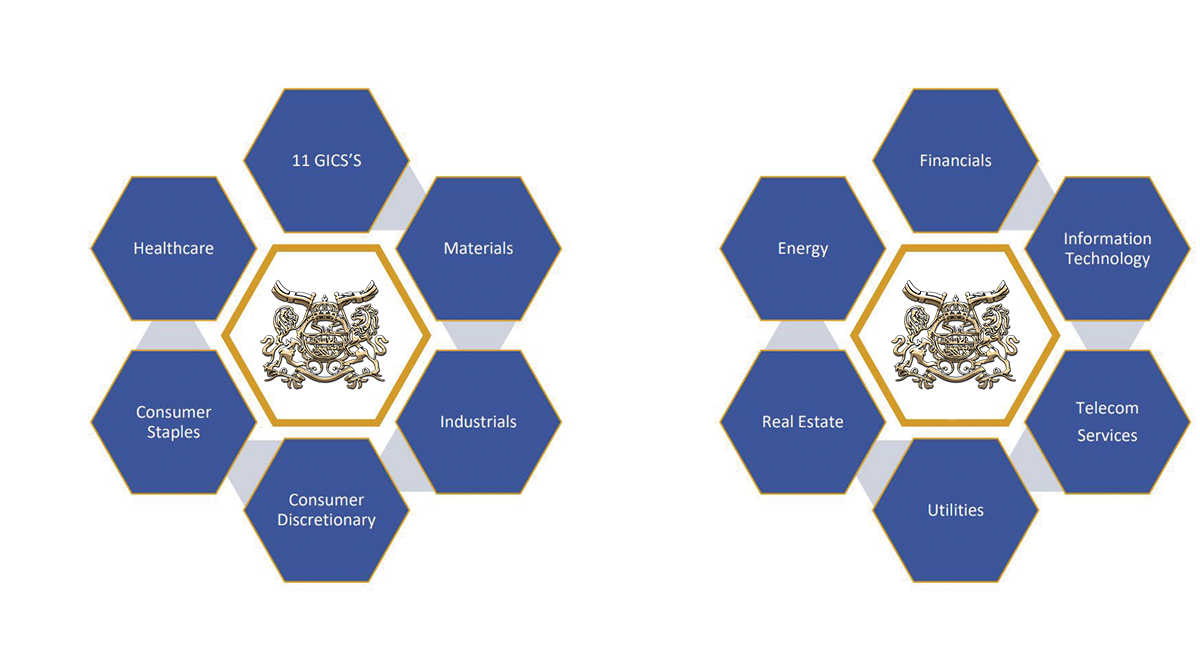

The stock market allows numerous buyers and sellers of securities to meet, interact, and transact. Stock markets allow for price discovery for shares of corporations and serve as a barometer for the overall economy. Since the number of stock market participants is huge, one can often be assured of a fair price and a high degree of liquidity as various market participants compete with one another for the best price. At SDI, we invest across the 11 sectors, as recognised by the Global Industry Classification Standard (GICS), to provide our clients with a diversified stock portfolio.

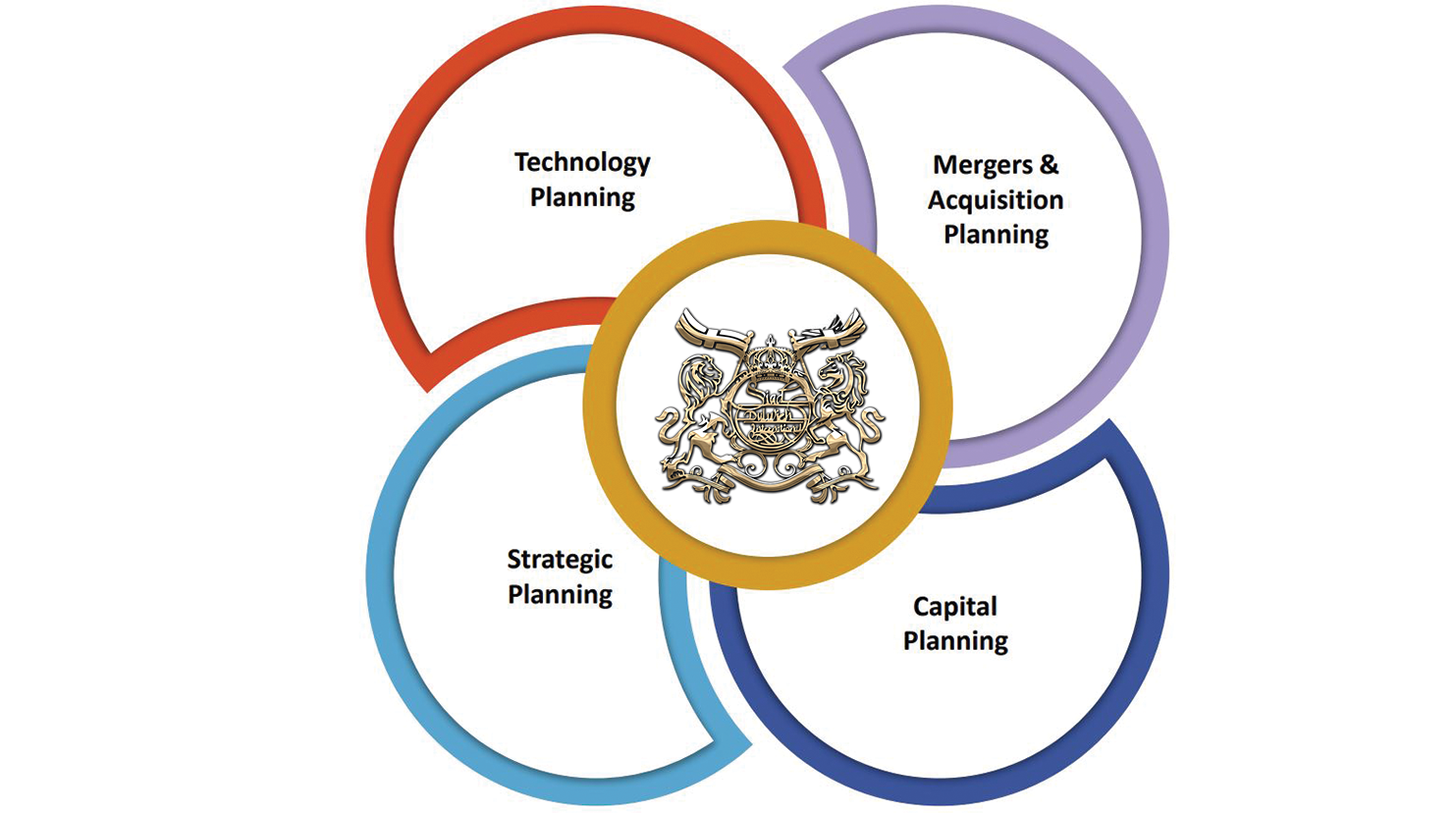

At SDI, we understand the advantages of creating a robust strategic plan, taking a business from its current position to its desired future position. We will work with our investors, investees, and stakeholders to support the development of strategic, tactful and operational plans to deliver value to high growth potential companies.

At SDI, we can offer solid advice to organise investments through structures to optimise tax advantages and ensuring that all required taxes are paid in accordance with the client residences/domicile status. This is closely managed with the Immigration and Lifestyle team.